clay county tax collector mo

How to fill out personal property tax. GISMapping Assessors Office Clay County MO phone.

Mcevoy Resigns As Clay County Collector 102 7fm Kpgz

Clay County Tax Collector PO Box 218 Overnight Mail - 477 Houston St Green Cove Springs FL 32043.

. 19-89506 2021 WL 4977443 at 5 Mo. Clay County Missouri 1 Courthouse Square Liberty Missouri 64068 816 407-3600. Click on the map to start measuring a line.

Your Property Tax Payment List is Empty. Starting November 1st Property Tax payments can be made without an appointment at our Green Cove and Keystone branches or by making an appointment at our Bear Run and Park Avenue branches. 816 407-3501 Email the Assessor.

Double Click on the map to end area measurement. From her start in Gladstone to Wentzville Harrisonville and Olathe Ms. Clay County Courthouse 1 Courthouse Square Liberty Missouri 64068 Phone.

Monday Friday 800 AM 500 PM. Diane Hutchings Clay County Tax Collector. PO Box 218 Green Cove Springs 32043.

To search for a company or organization. Payments Made Payable To. Cash checks debit credit cards VisaMCAmExDisc-250 fee.

Payments Made Payable To. PERSONAL PROPERTY TAXES Clay County Missouri Tax 2017-06-14T125229-0500. Click on the map to start measuring an area.

Clay County Assessor Cathy Rinehart. Office Locations Hours. Clay County Mo.

Based On Circumstances You May Already Qualify For Tax Relief. Ad Receive Clay County Property Records by Just Entering an Address. Office Locations Hours.

Property Account PARCEL Number Search. A Missouri native Ms. Cash checks debit credit cards VisaMCAmExDisc-250 fee.

PO Box 1843 Green Cove Springs 32043. Mail DMV payments turn in tags to. Mail Tax payments to.

Clay County Tax Collectors Office Contact Information. The assessed valuation is provided from the Clay County Assessors Office by requirements of the Missouri State Statutes. GISMapping Assessors Office phone.

Credit card payments will still incur a fee. Clay County Welcomes Administrator Wright. The convenience fee is not paid to Clay County.

To search for a business name use the Last Name field. You must pay in person at one of our office locations. The Rushmore Method enables a valuation of hotel real estate by deducting the value of a franchise affiliation and.

The format for Real Estate is 14 numeric digits. Mail DMV payments turn in tags to. All payments by check and debit card Visa MasterCard and Discover debit are FREE.

Ad See If You Qualify For IRS Fresh Start Program. For answers to questions concerning the assessed. 816 407-3501 Email the Assessor.

Wright has brought her. 816 407 - 3370 email. 816 407 3370 email.

Free Case Review Begin Online. Assessor Taney County Mo Appeal No. Mail Tax payments to.

PO Box 1843 Green Cove Springs 32043. Clay County Assessor Tracy Baldwin. Diane Hutchings Clay County Tax Collector.

Tax Search and Payment Processing - Help. Tax Commn 2021 noting the STC has long recognized the Rushmore Method under the income approach for the valuation of hotel properties. PO Box 218 Green Cove Springs 32043.

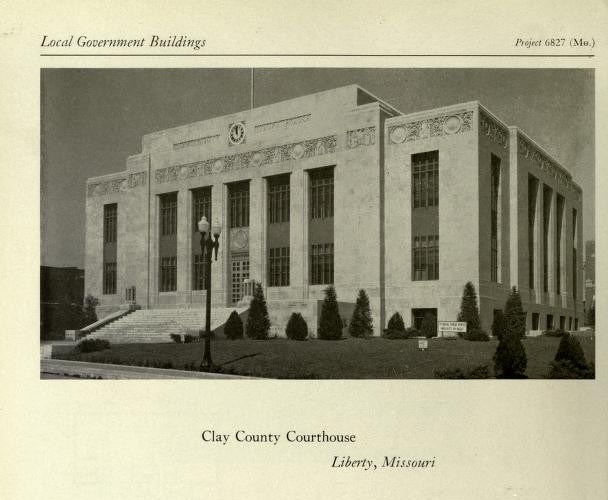

Find Clay County Online Property Taxes Info From 2021. See Property Records Tax Titles Owner Info More. Name Clay County Tax Collectors Office Address 1 Courthouse Square Liberty Missouri 64068 Phone 816-407-3200 Fax 816-407-3201.

Clay County Courthouse 1 Courthouse Square Liberty Missouri 64068 Phone. Business Personal Property 816-407-3460. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

Monday Friday 800 AM 500 PM. The Clay County Commission is pleased to announce the appointment of Dianna Wright as the new County Administrator. The format for Personal Property is 14 numeric digits the first three digits are zeros.

Address Phone Number and Fax Number for Clay County Tax Collectors Office a Treasurer Tax Collector Office at Courthouse Square Liberty MO. The discount for walk-in payments is extended to the next working day when the deadline falls on a weekend or observed holiday. View on Google Maps.

Wright has extensive public sector experience serving over 30 years at the executive level. Click here for holiday closings. Search Any Address 2.

The City of Liberty property tax levy is 07968 per 100 assessed valuation this includes 06775 for the Citys General Fund and 01193 for Liberty Parks Recreation. 33000 indicated only that the costs were for Administrative Tax Sale Costs The County Collector generally uses tax sale fee records to ensure amounts invoiced are accurate but did not maintain those records for this Clay County County Collector Management Advisory Report - State Auditors Finding 1. The Tax Collector collects all ad valorem taxes and non ad valorem assessments levied in Clay County.

Clay County Collector S Office Liberty Mo Living New Deal

Meet Your Tax Collector Monroe County Tax Collector

Clay County Collector Assessor Accounting Clay County Missouri

Clay County Collector What To Do If You Were Late On Your Property Taxes The Northland News

Sheila Ernzen Clay County Treasurer Clay County Missouri Linkedin

Faq Categories Personal Property Tax Clay County Missouri Tax

Clay County Collector S Office Liberty Mo Living New Deal

20 Million Clay County Annex Project To Move Forward After Lawsuit Against City Dropped Youtube

Clay County Collector Assessor Accounting Clay County Missouri

How To Use The Property Tax Portal Clay County Missouri Tax

Clay County Collector What To Do If You Were Late On Your Property Taxes The Northland News

Clay County Courthouse Annex Kc History

See Where You Can Drop Off Taxes In Clay County Without Having To Get Out Of Your Car Fox 4 Kansas City Wdaf Tv News Weather Sports

Mcevoy Resigns As Clay County Collector 102 7fm Kpgz